Why B2B Revenue Leaders are Falling for the Myth of Being "Data-Driven"

Has there been any phrase more overused in business lexicon over the last two decades than “data-driven”?

Over the last decade, we’ve observed a number of major sales and marketing pitfalls that hinder B2B startups from reaching their growth potential and often drive them into stagnation.

Although these issues are not unique to B2B startups, they are most damaging for investor-backed companies with high-velocity sales models, where success is more about science (methodology, process, repetition, and data) than it is about relationships.

These five top pitfalls waste precious time and consume expensive capital. If not properly addressed or solved, the impact is damaging: shortened runways, elevated customer acquisition costs (CAC), and constrained growth.

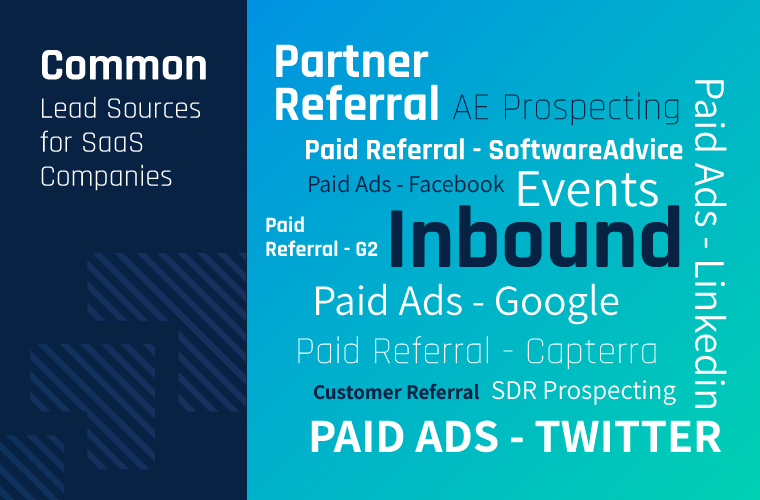

A key role of CEOs and revenue leaders is to understand the relative returns of the various lead sourcing strategies they are using to acquire customers, so that they can deploy their available dollars in a way that maximizes returns.

No CEO or revenue leader would ever consciously invest good money in fruitless strategies, but too many companies are making decisions on sales and marketing spend without a precise way of measuring returns.

Typical growth-stage companies that have velocity go-to-market models deploy anywhere from 3-7 strategies for sourcing new business.

Without end-to-end visibility into how each of those lead sourcing strategies are working relative to each other, blind, unconscious investing in low yielding strategies is rampant.

In our experience, most companies attempt to measure the cost per lead from the various strategies but don’t actually measure the end-to-end cost effectiveness for a strategy and therefore they end up committing dollars to a particular strategy when that money would be much more productive if deployed on a different strategy.

Here’s an example of how it can happen, even with the best of intentions:

One of our SaaS customers had invested in Facebook ads to generate top of funnel leads (such as ebook downloads and webinar registrations) for about six months before they began working with scaleMatters.

From a marketing/top-of-funnel standpoint, the economics were unbelievable. The company was spending only $7 per lead and generating thousands of leads per month. With an Average Selling Price (ASP) of $11,000, it was a recipe for success, so they thought.

After instrumenting their technology environment and gaining end-to-end, full funnel visibility into all their lead sourcing strategies, we began to notice two concerning trends:

These two factors made the end-to-end Facebook ads funnel far less cost effective than their SDR outbound prospecting strategy. And, like most companies without a warchest of cash to burn, our customer had to shift their limited resources away from Facebook advertising and into hiring more SDRs.

They had the data and insights to confidently pivot in the short-term, while also knowing that when they raised more money they could quickly restart Facebook ads to generate more leads.

Measure the end-to-end cost effectiveness of each demand generation strategy.

We’ve seen funnel misalignment in almost every growth stage company we’ve worked with in the past decade. Resource capacity applied to top-of-funnel and bottom-of funnel is not aligned. In most cases, companies have too many salespeople (account executives and closers) on staff and not enough inbound lead flow and set meetings to support them. The result? A staff full of frustrated salespeople who can’t hit quota.

Yet, too many companies still believe in the old-school mantra that growth is driven by the number of salespeople, so they’re reluctant to shrink the sales staff and redeploy the savings to top-of-funnel activities, which is exactly what they should do. Instead, they waste money on salespeople they don’t need and can’t use.

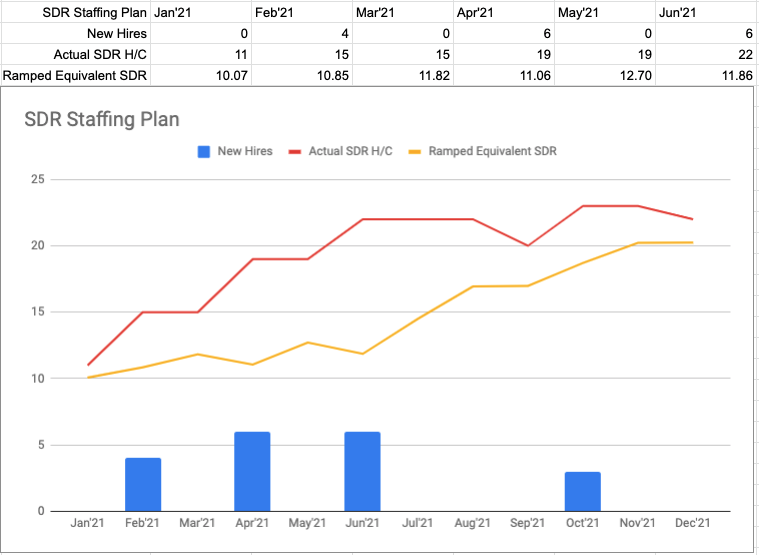

Solving this problem involves first building plans with a top-down approach; your investments in generating leads should guide your sales staffing and headcount requirements.

Additionally, you’ve got to really know the maximum capacity of an account executive. This is a hard number to pin down because it varies due to a variety of factors, such as the complexity of your sale, how many demos are required, and more. For velocity sales models, SaaStr’s Jason Lemkin advises that a rep can handle 50 demos per month.

(In case you're interested, here’s a free model for building your SDR + AE staffing capacity.)

Over-investing in top-of-funnel lead generation without the sales staff to respond to the leads is also wasteful. Leads aren’t responded to quickly enough (we’ll cover that more in our next section) as limited sales people pick and choose which leads to follow up based on their gut instinct of who seems qualified.

This is an easier problem to solve: The HR department needs to build a pipeline of qualified sales candidates, and sales leaders need to establish comprehensive onboarding plans so that when marketing starts bringing in more leads than sales can handle, it’s easy to add capacity by hiring and onboarding new sales people at the right time.

Until that additional salesperson capacity is onboard, however, the existing sales team needs to step up to the plate and close more deals per head if there is an abundance of leads.

Balance your sales capacity with lead volume.

Great data to make good decisions is the outcome of properly configured technology and well-designed processes. Unfortunately, process friction points are everywhere and can be major contributors of sales and marketing waste. Th is friction is the result of tech stacks that are installed reactively by sales and marketing leaders, not thoughtfully architected by IT leaders.

Rarely do early-stage companies have the bandwidth and resources to construct their tech stack from the ground up. The first sales leader brings on a CRM, marketing installs a CMS or marketing automation system when the urgent need arises, a live chat tool is later installed, followed by a sales acceleration tool for outbound prospecting. All of a sudden, there are multiple tools capturing and storing data, but they aren’t seamlessly connected. Not only is accurate performance reporting impossible, but operating in this convoluted environment is full of pitfalls.

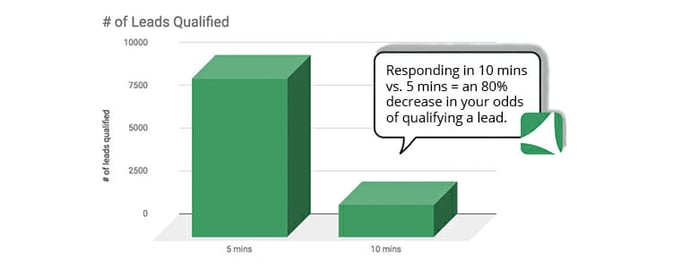

A simple, common example is the process for routing and responding to inbound leads. Time and time again we’ve observed breakdowns in this process, whether it’s the element of distributing these leads to the SDR or sales team, or the timeliness of following up by the SDR or sales team.

Studies have shown that waiting longer than 5 minutes to respond to an inbound lead decreases your chance of qualifying them by 80 percent.

Source: Vendasta

Leads have a shelf life and the further the lead is in the funnel, the shorter that shelf life becomes. These process breakdowns are the killer of efficiency. All this money is invested to generate traffic and convert leads, and that money is essentially squandered with slow or no follow up.

There are countless other examples of process friction points that all add up to significant missed opportunities and missed revenue.

Thoughtfully architect your sales/martech to match efficient business processes.

Just like many companies are squandering money on low yielding strategies, they are also wasting money on low-performing employees. This is most obvious with SDR teams and sales teams.

We see very few companies that have a precise understanding of the profile criteria of a very successful salesperson, and even fewer that have a rigorous way to test against that criteria during the hiring process. Bad hire rates are super high—often as much as 50 percent for salespeople and 75 percent for SDRs.

Sales candidate assessments like OMG are incredible at helping you understand the qualities of your best salespeople and sales managers, and then running candidate assessments that test for those qualities!

For marketing hires, previous work examples are always the best indicator of talent, but pre-employment testing tools like Criteria can help you make more informed hiring decisions.

Making matters worse, early and growth stage B2B startups often don’t have precise early indicators of success, so it can take many months before they know for sure if someone is going to be adequately productive or not.

Then, when they realize they’ve got an underperformer, companies are slow to part ways and hold out hope for too long. In the spirit of fairness, hot leads continue to get routed to sales reps with the lowest win rates—and we all know hot leads are expensive.

Even though the leadership team knows they are getting a lousy return on investment, they’d rather get the few deals per month delivered than lose that salesperson’s contribution altogether.

And the cycle goes on and on… Bottom line: Nonproductive salespeople waste good leads and payroll.

Strengthen hiring criteria. Move on from underperformers faster.

Product/market/message fit is absolutely essential to building a valuable company. You must have a product that fulfills a legitimate market need and you need to be able to communicate your capabilities and value proposition in a clear, compelling and concise way.

It’s difficult to achieve a perfect product/market/message fit. For many growth stage businesses, they’re still a long way from it.

With suboptimal messaging, all your new logo acquisition efforts become more difficult. For example:

The dollar impact of suboptimal messaging is harder to measure than other waste factors, but its negative impact cuts across the entire customer acquisition function.

Listen to what your prospects say on sales calls and exploit the power of conversation data.

Each of these five factors individually might only contribute 10 percent waste for your revenue teams. But, adding all these waste factors together results in 50 percent waste, which significantly impacts your CAC and revenue growth rate.

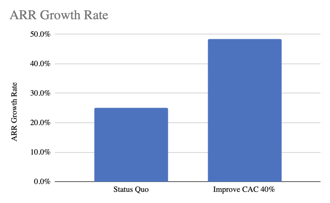

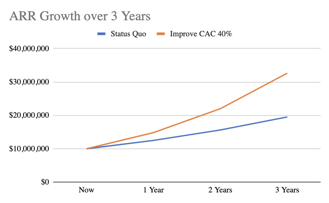

If some of that waste could be cut out and redeployed into growth, it would lower CAC, drive growth rates higher, and (potentially) boost your valuation. As an example, for a $10M ARR SaaS company here's the impact that reducing CAC would likely have on your growth and growth rates:

Has there been any phrase more overused in business lexicon over the last two decades than “data-driven”?

This article is for revenue leaders and RevOps people who are frustrated with the inability to get trustworthy data to make smart analytical...

It's common to think of data as just an operational component for sales and marketing teams. But did you know that the quality of your data can...