Originally published in April 2023

Note: This is an actual scaleMatters analyst insight report delivered to our customer's executive leadership team in April 2023. To protect customer privacy, their company name has been hidden from all charts. At the time of this writing, our customer was a growth equity backed $40M customer success software company.

🚨Decreasing Win Rate Across All Channels Especially in SMB Category [JAN-MAR 2023]

Summary Findings

Data seems to suggest that there are 3 contributing factors to the systemic low win rate:

- Macro conditions

- Relative ineffectiveness of more recent sales hire cohorts

- Increasing portion of top-of-funnel from SMB which really is non-ICP

Analyst Recommendation

SMB is by far the fastest growing segment in top-of-funnel, but doesn't represent true ICP prospects.

-

Consider shifting any paid ad targeting away from SMB.

-

Consider replacing sales resources that are following up with SMB leads with automated follow up.

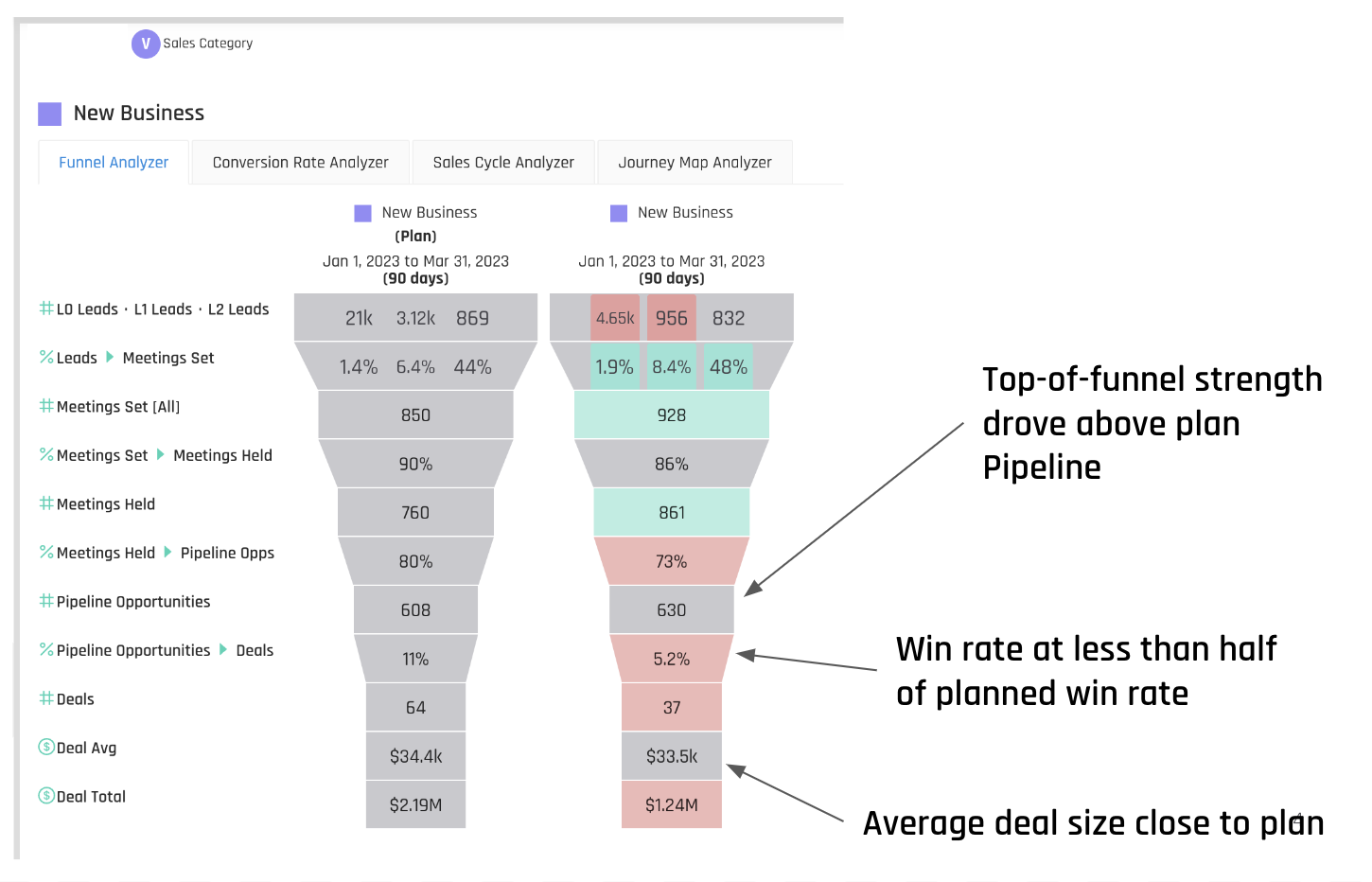

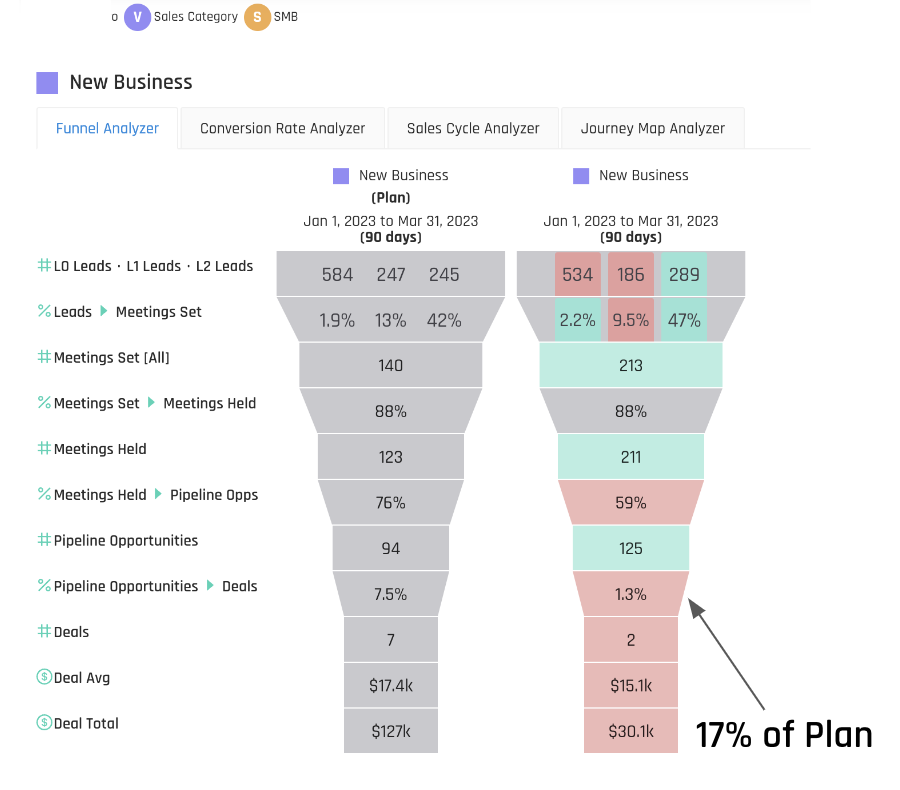

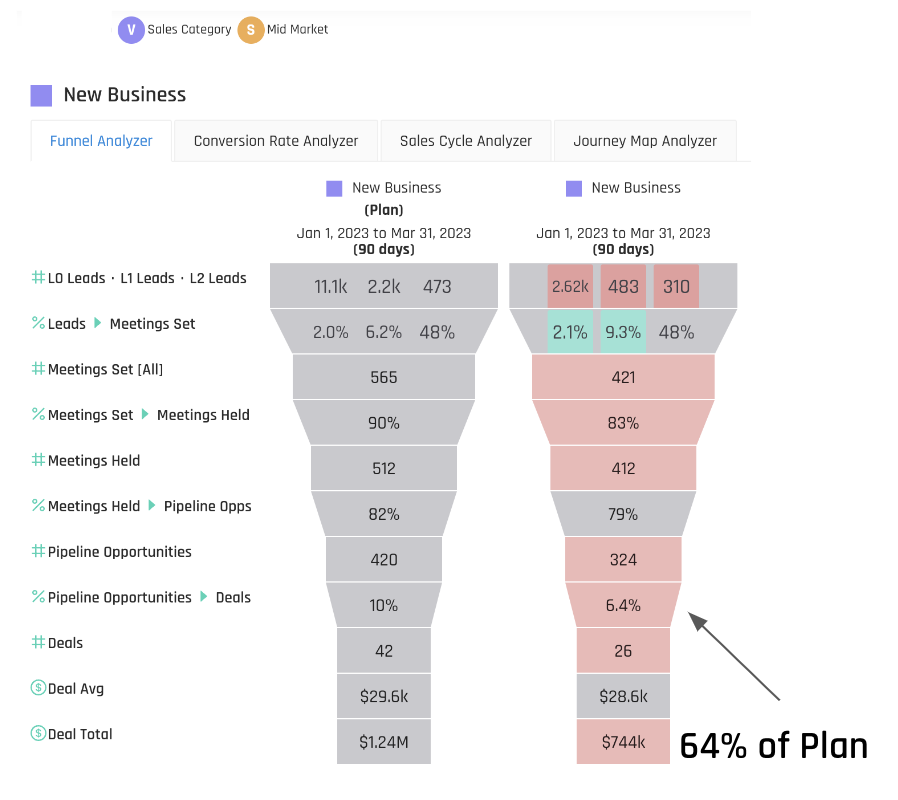

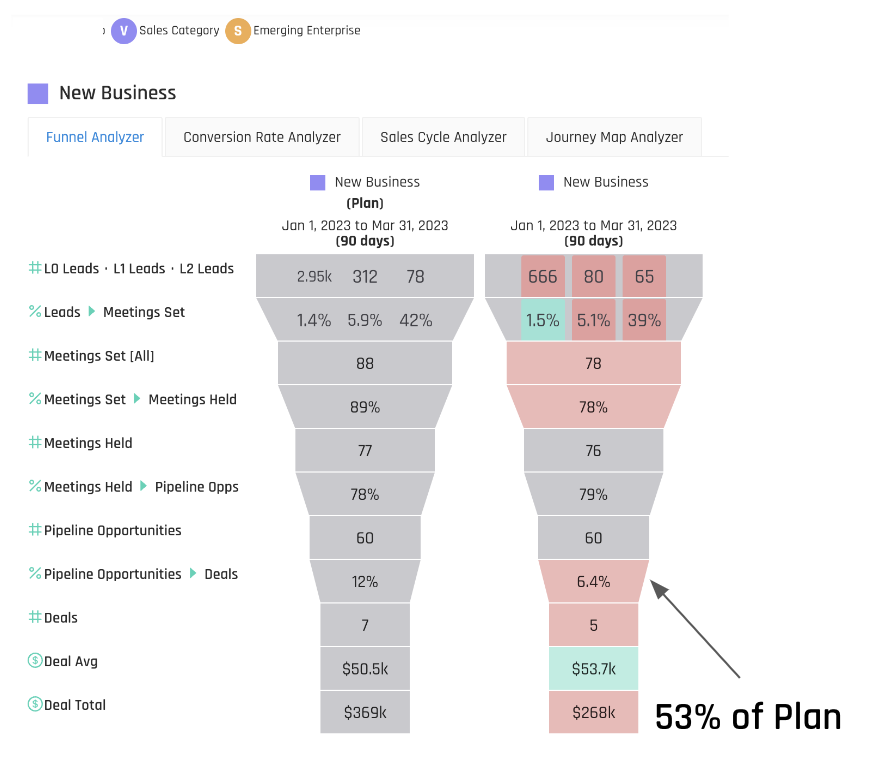

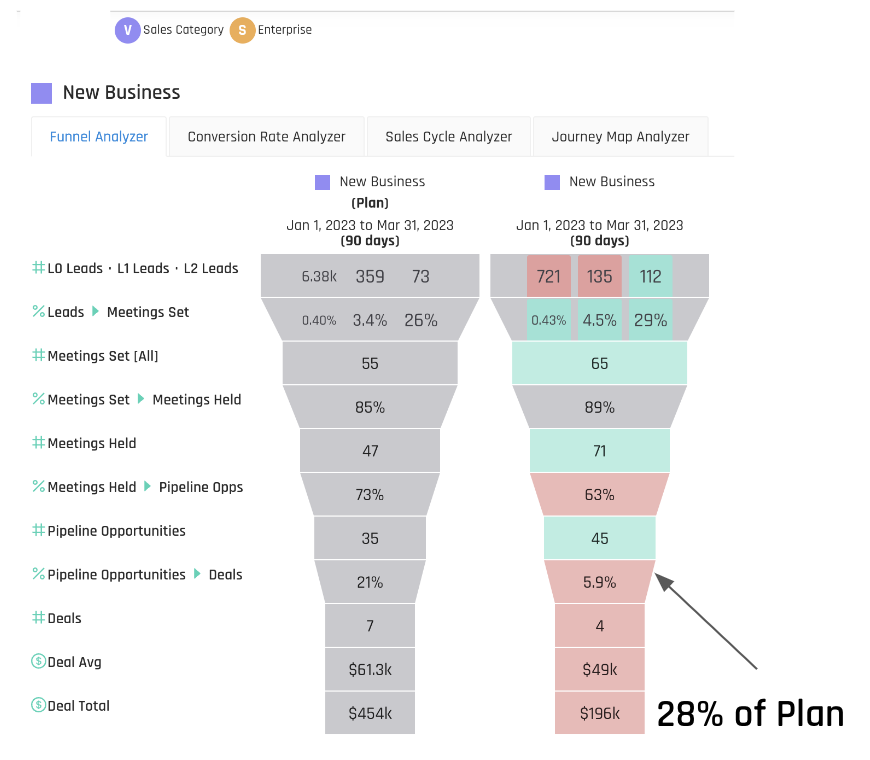

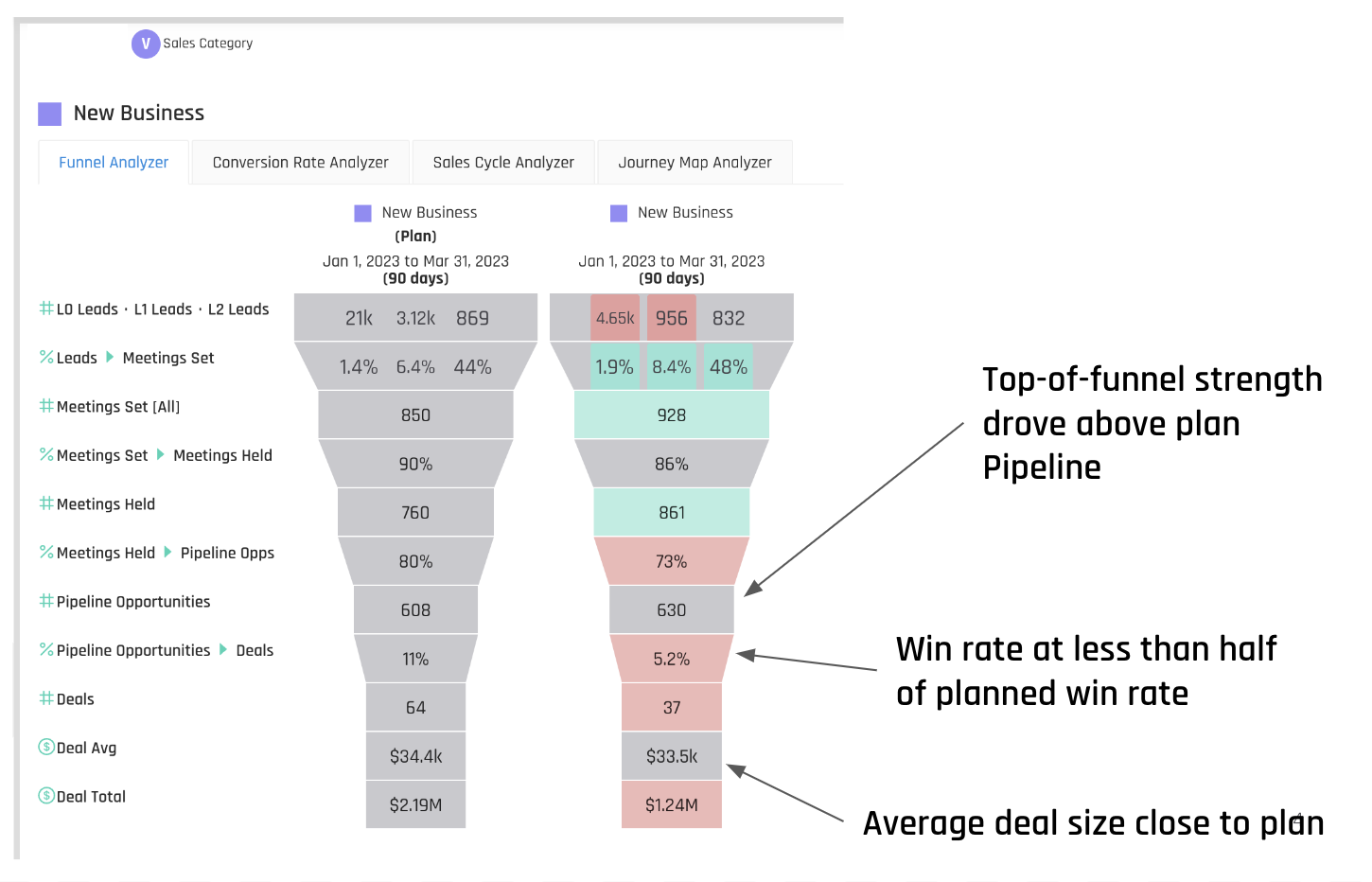

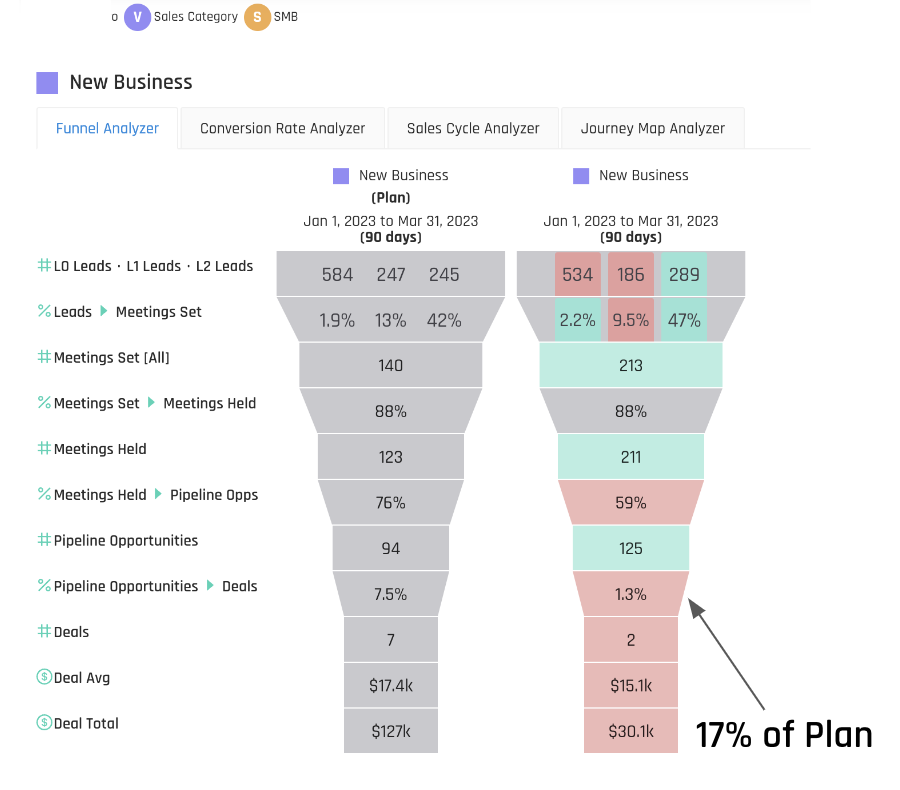

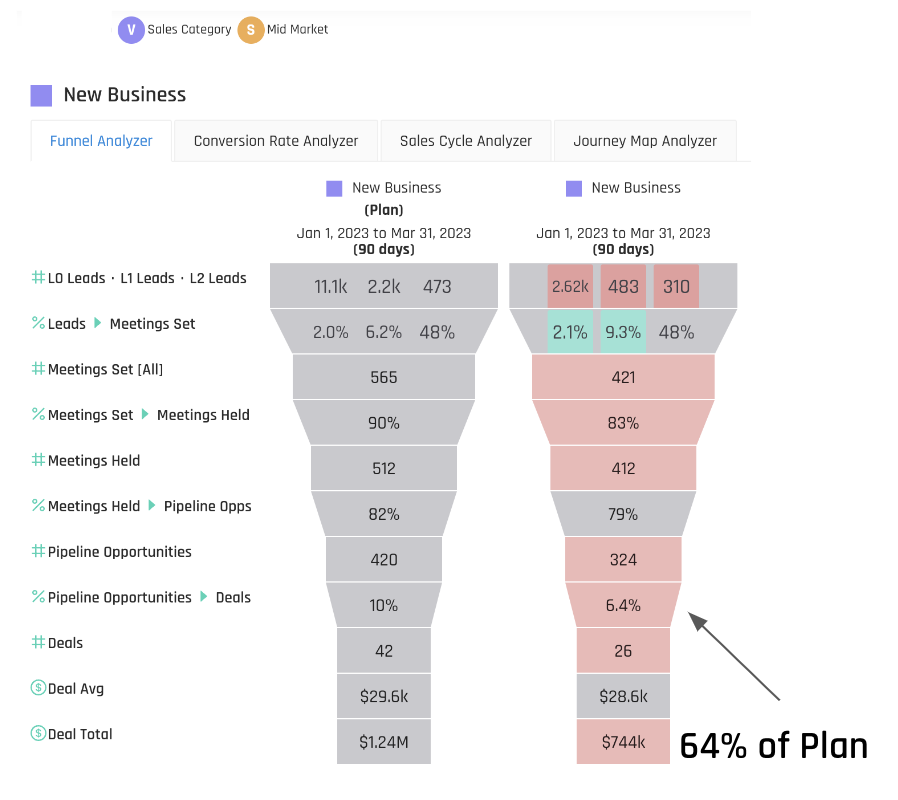

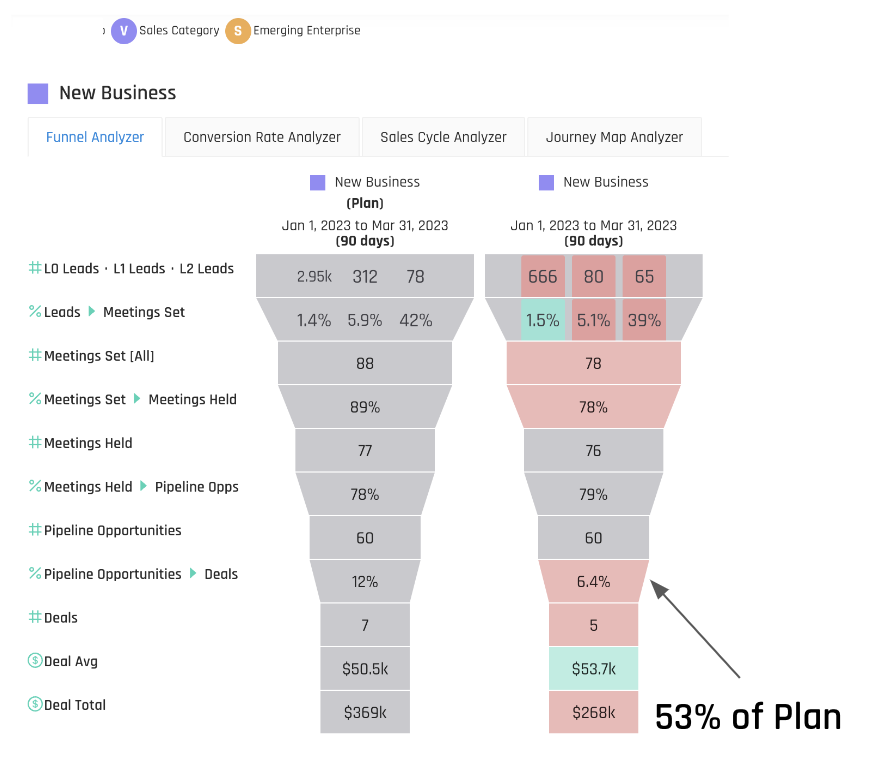

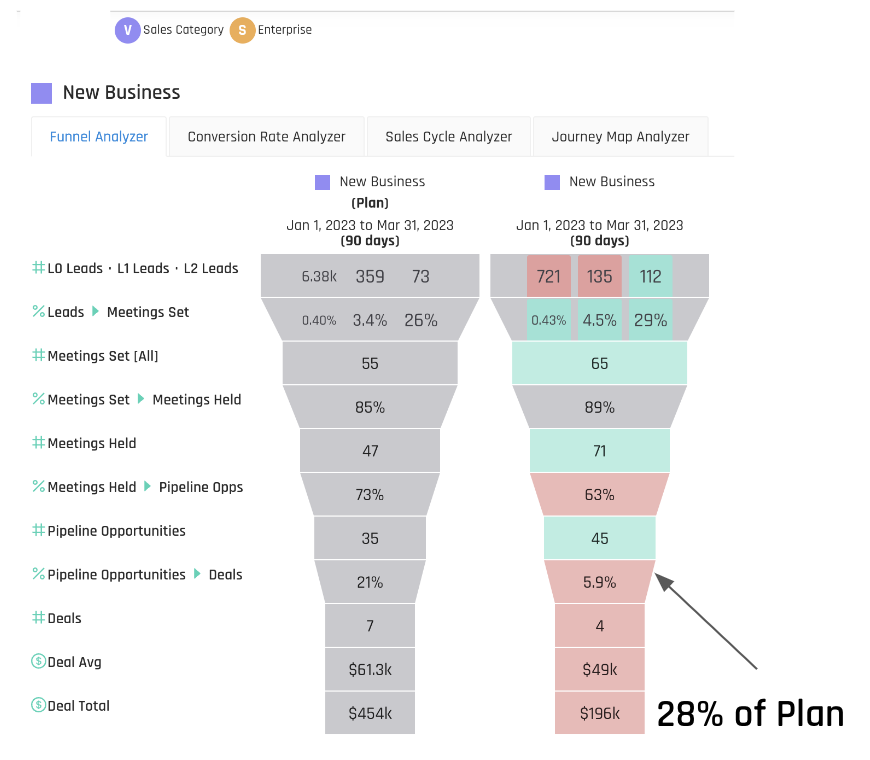

Q1'23 New Business Actual Performance vs. Plan

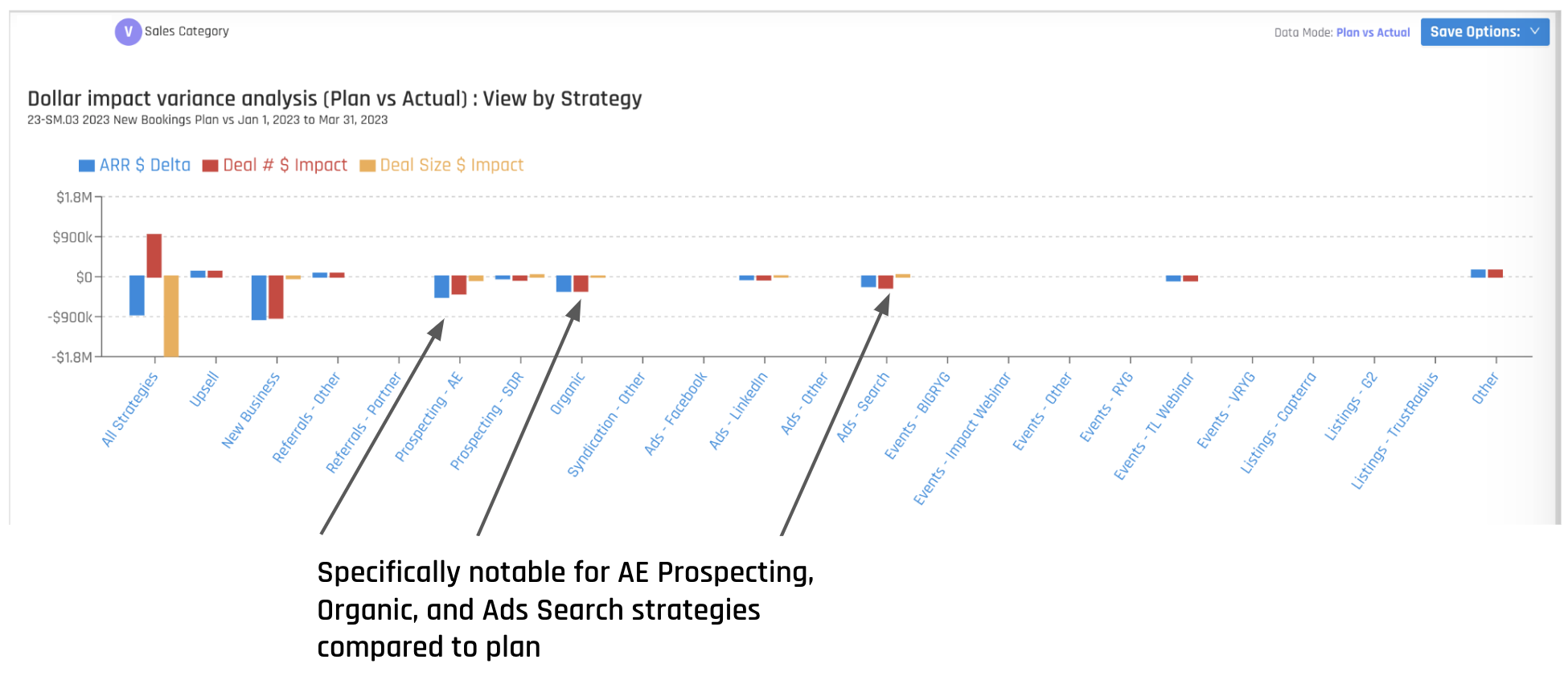

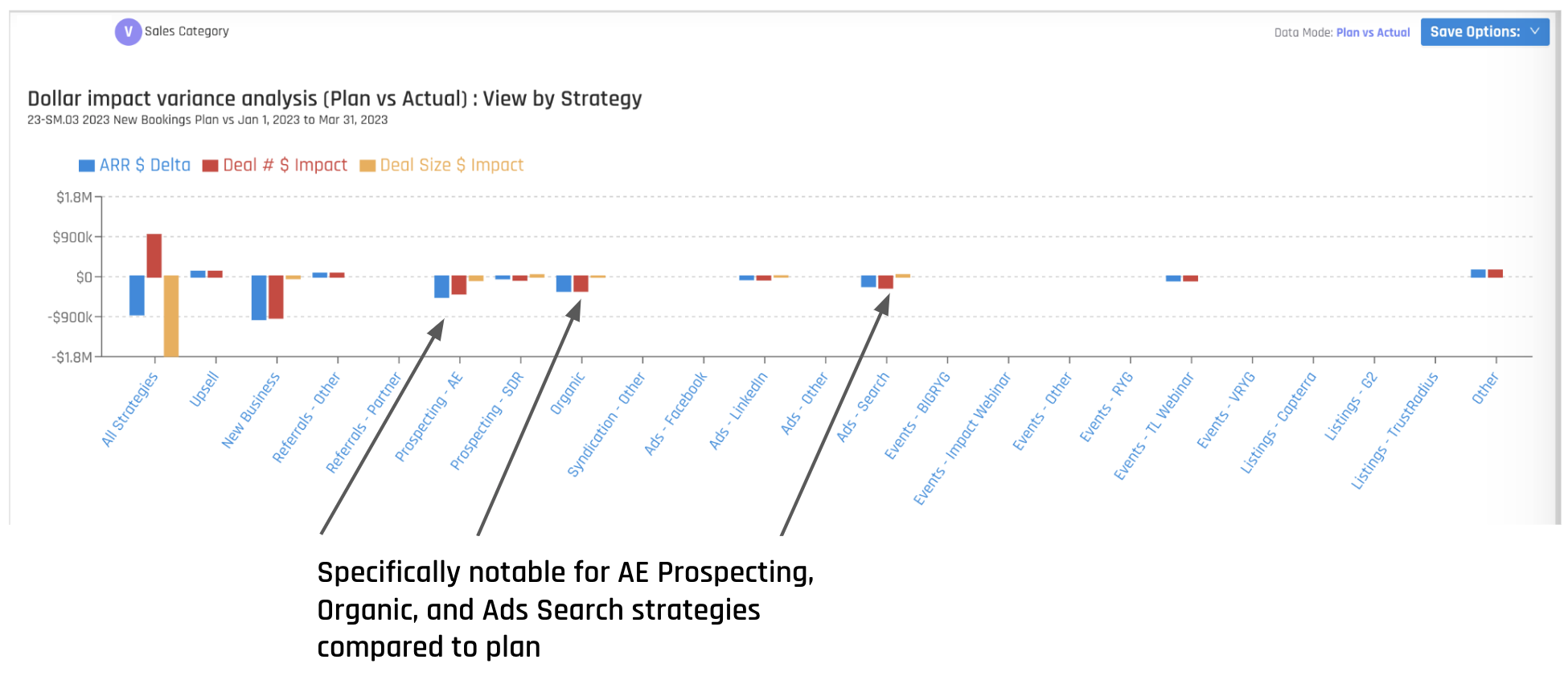

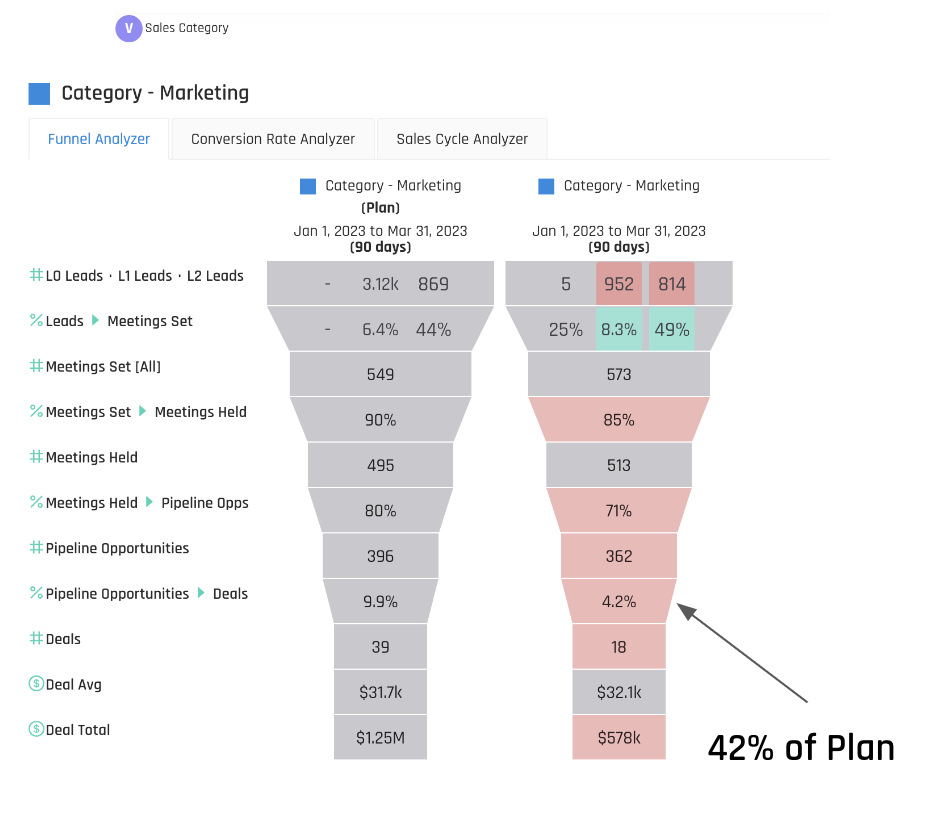

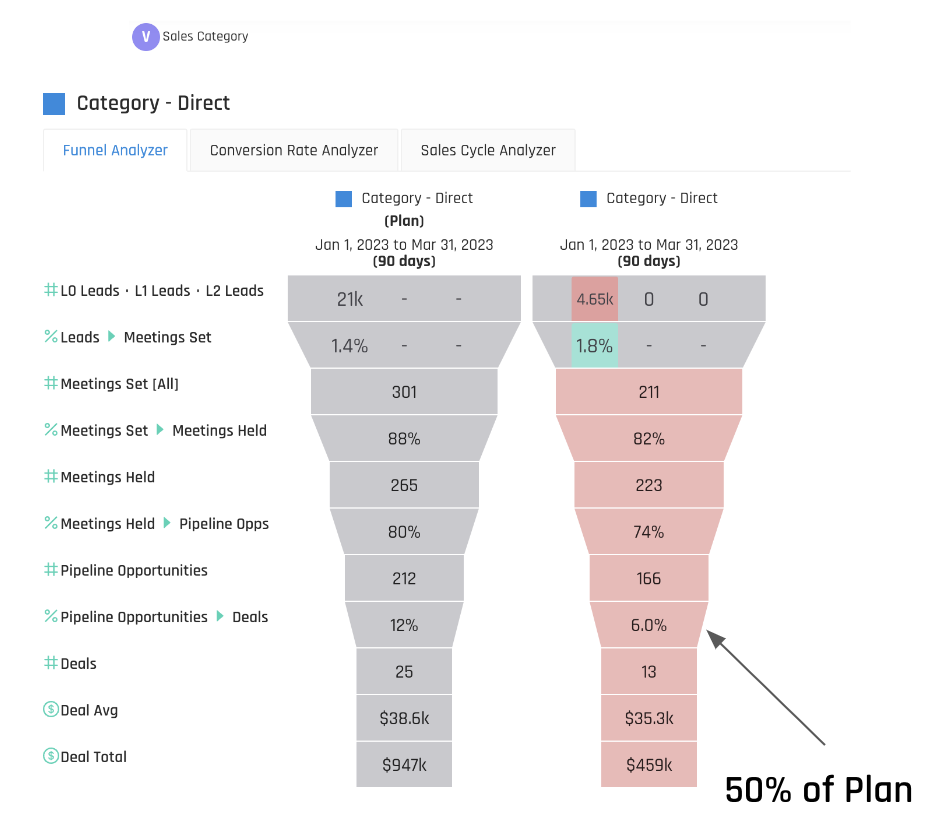

Dollar Impact Variance Analysis Shows Weakness Across Major Channels

Win Rate Far Below Plan for Both Outbound & Inbound Strategies

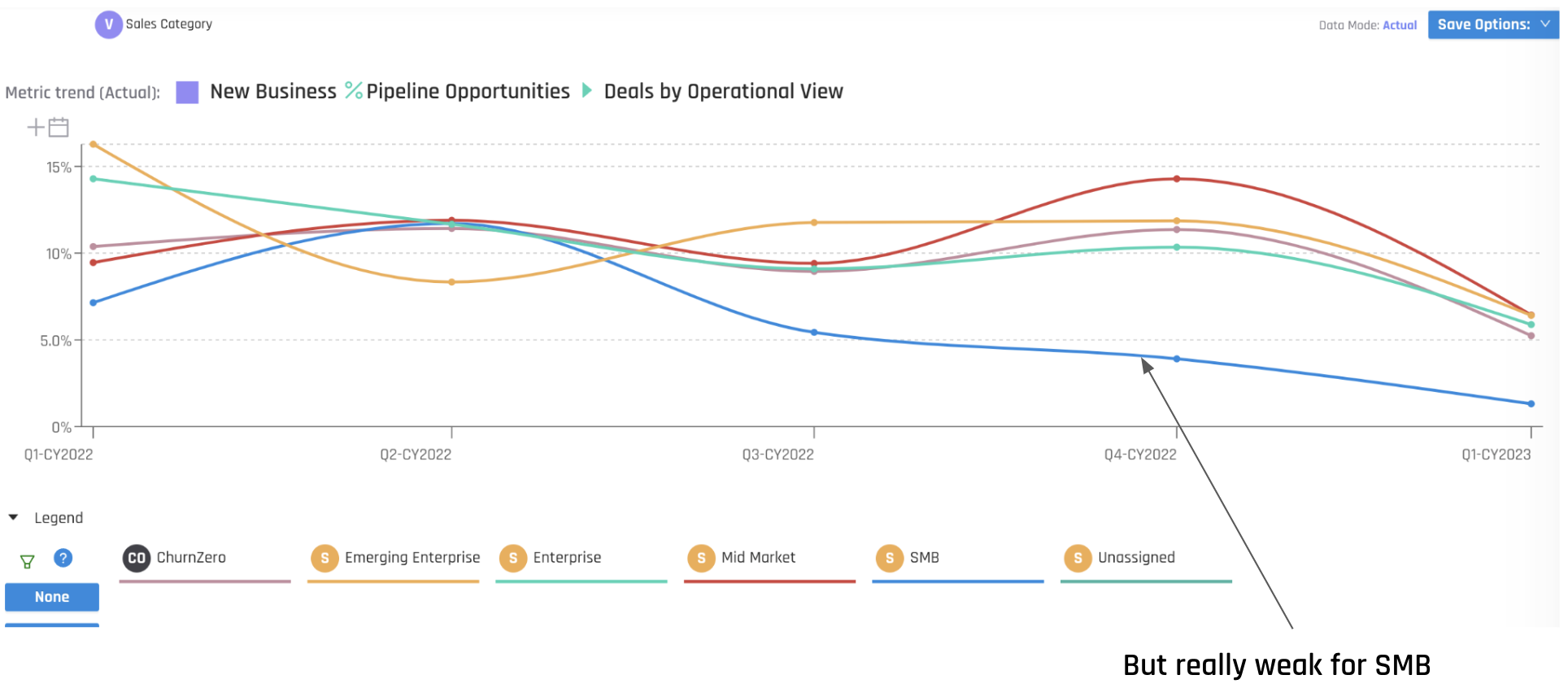

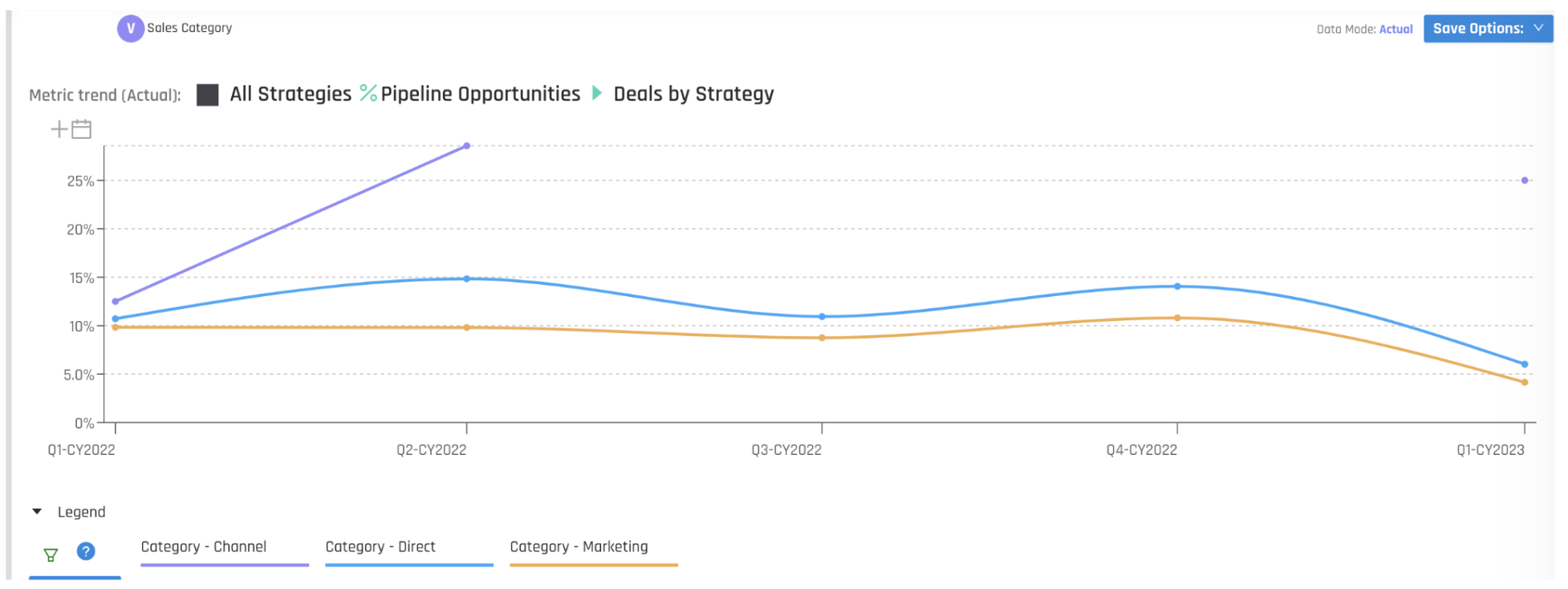

Weak Win Rate Trending for Both Outbound & Inbound Strategies

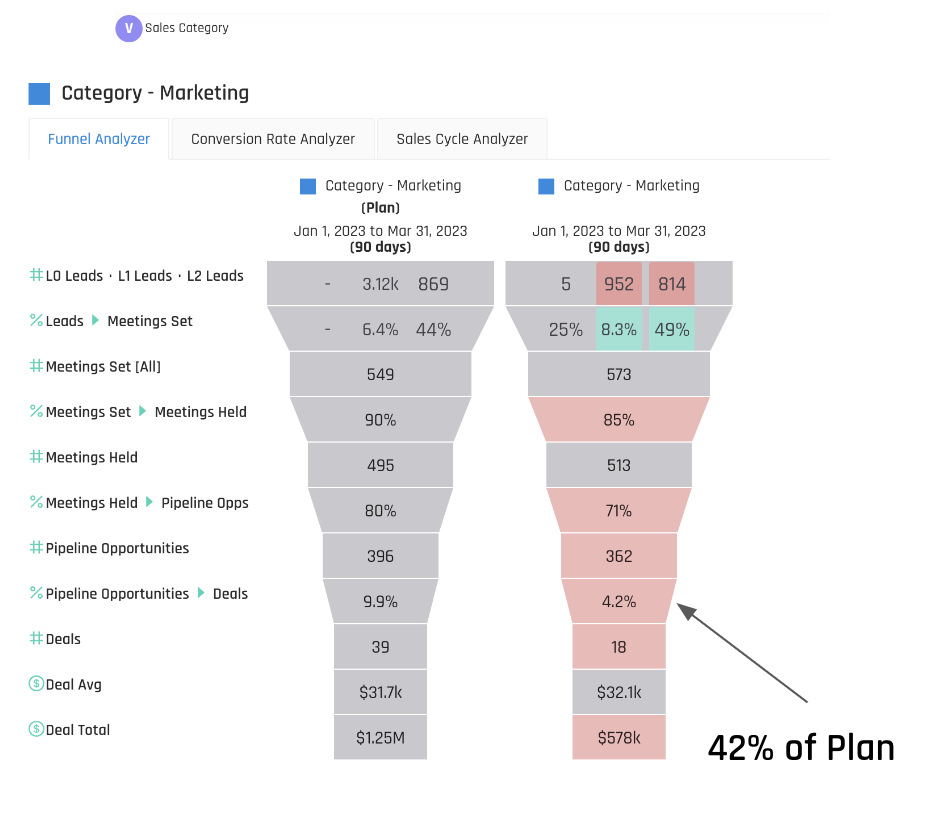

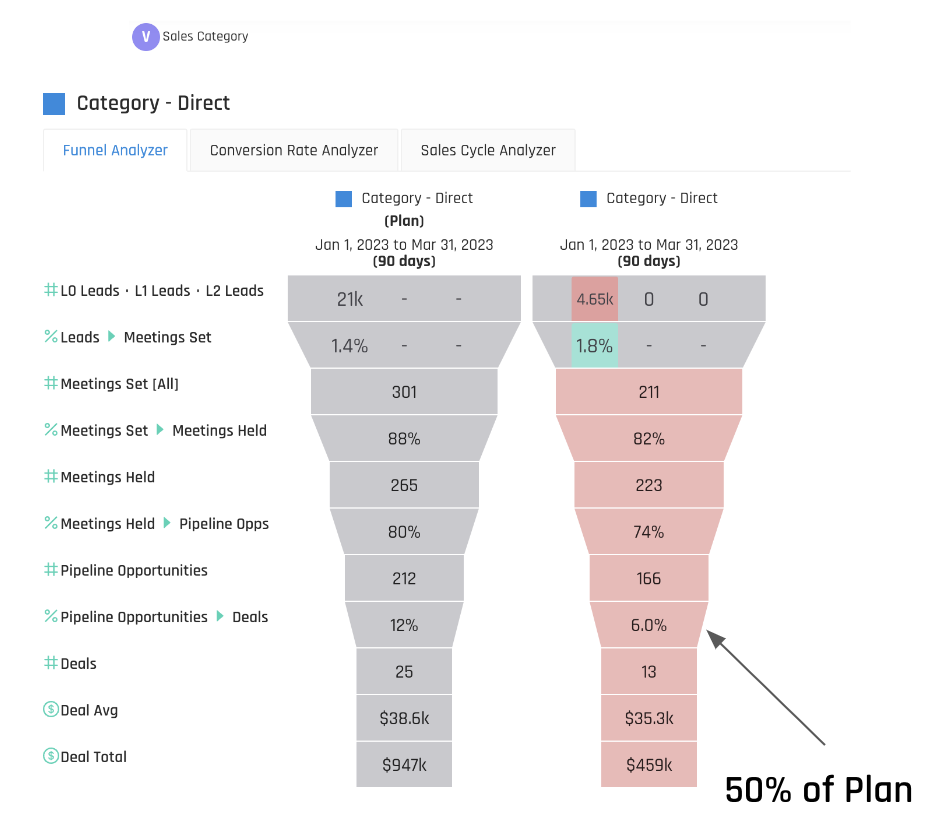

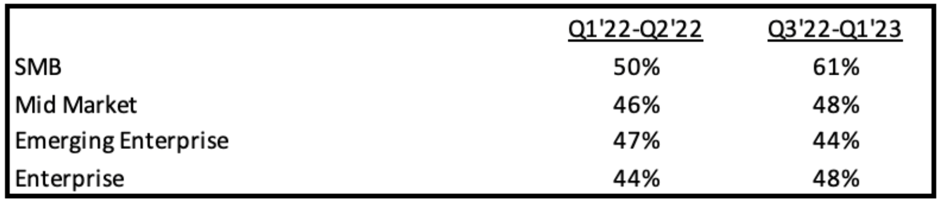

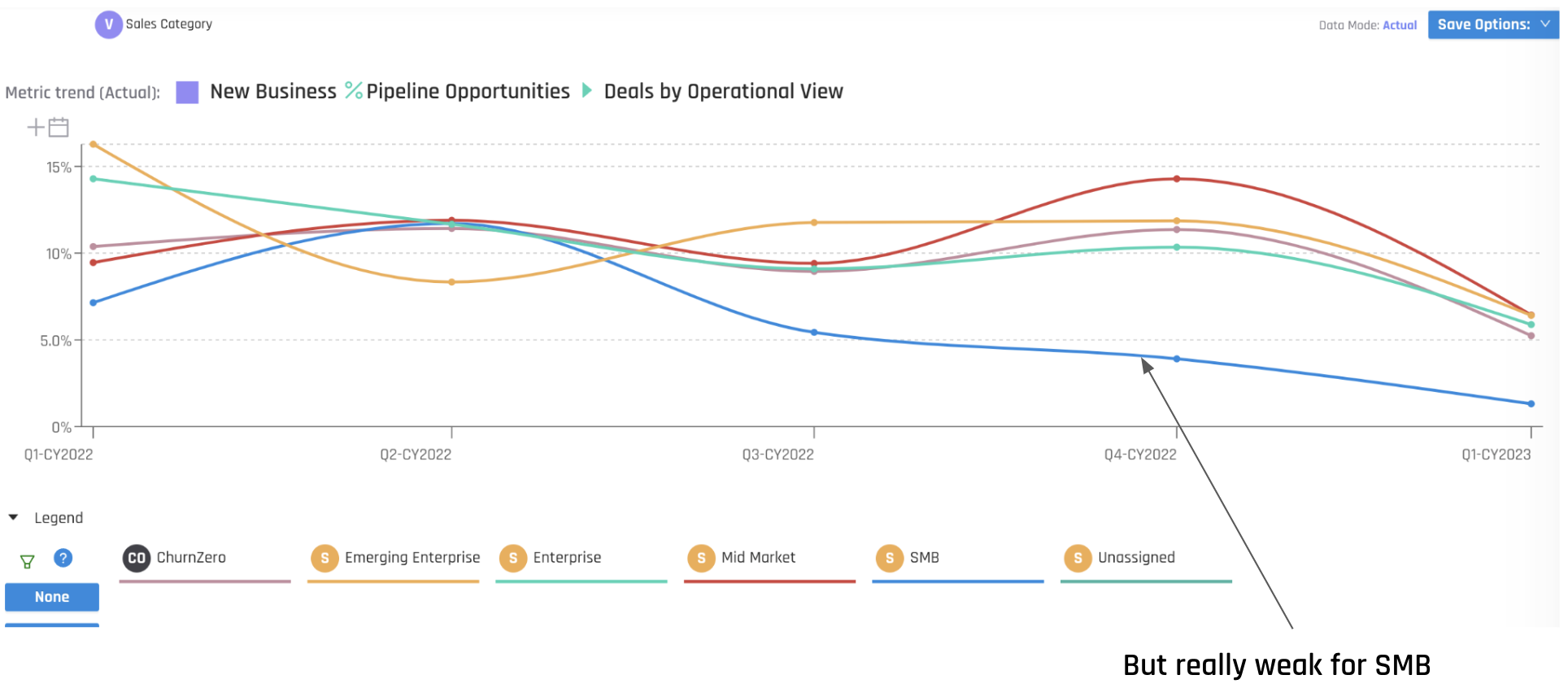

Weak Win Rate vs. Plan Across All Sales Categories - SMB, MM, Emerging, Enterprise

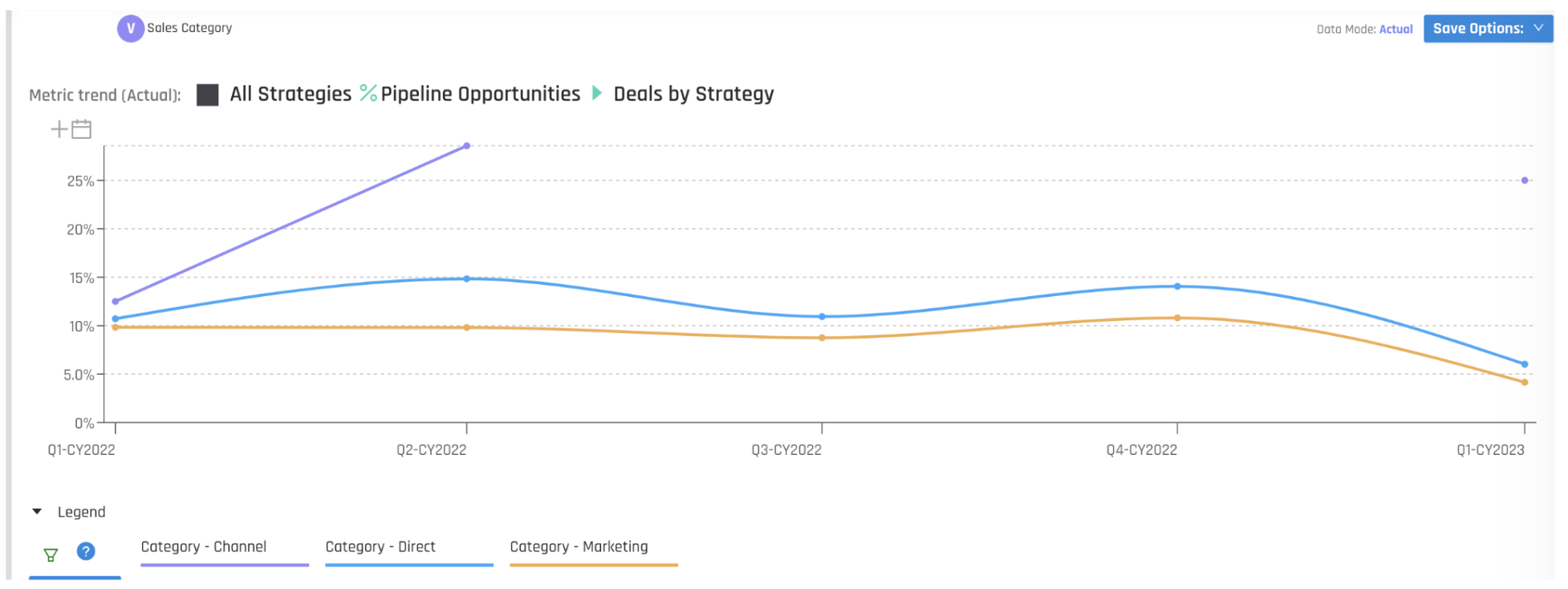

Weak Win Rate Trending Across All Sales Categories - SMB, MM, Emerging, Enterprise

Forensic Analysis

Problem: Friction with win rate in Q1 2023.

Action: Determine root cause so we can take corrective action

Possible Culprits to Investigate:

- Stronger competition

- Unfavorable macro trends

- Less capable sales team

- Increasing proportion of non ICP prospects

Are We Seeing Increased Competitive Pressure?

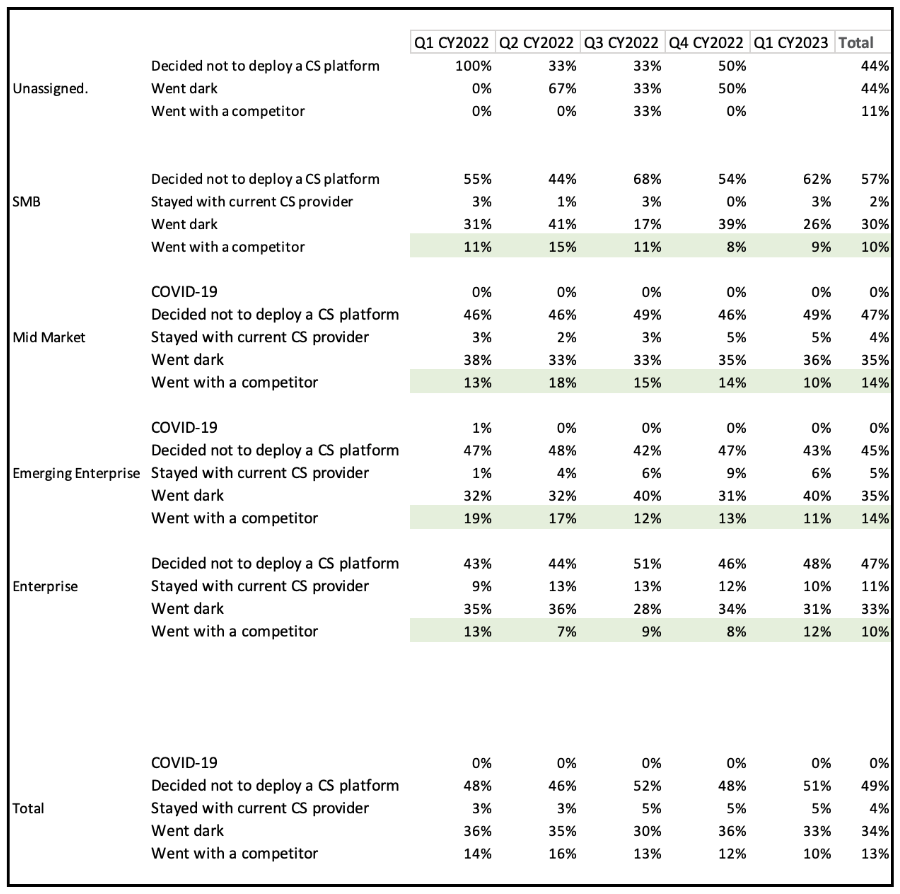

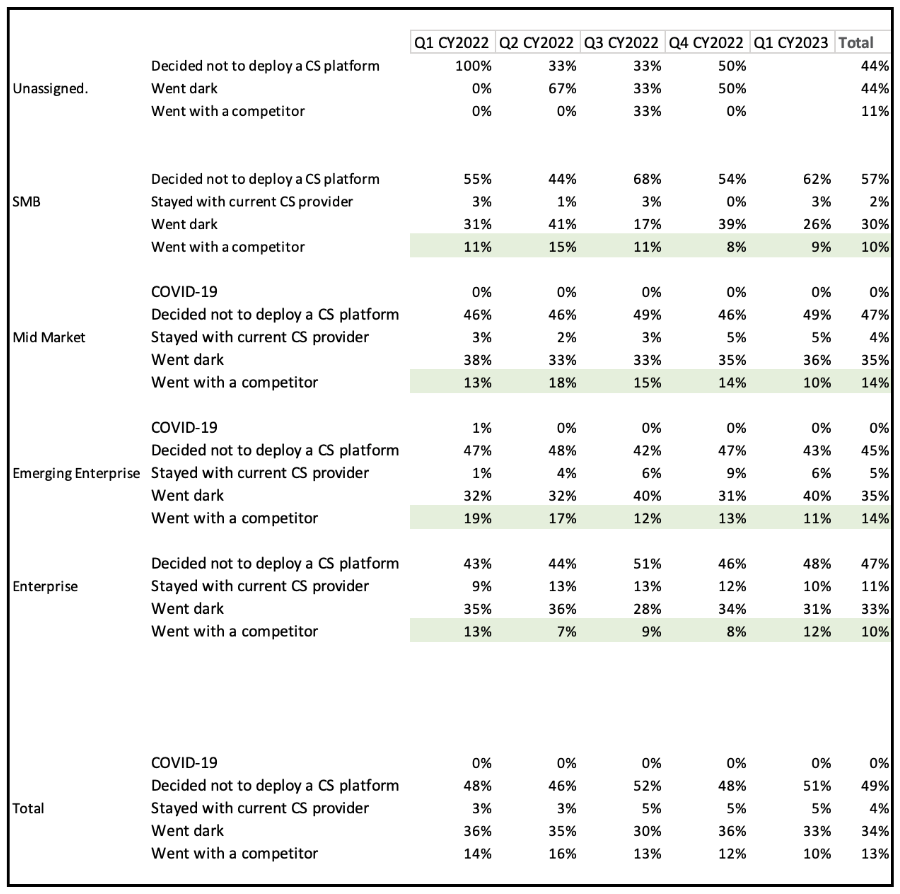

Looked at Closed Lost Reason trending by Sales Category to see if “went with a Competitor” is increasing as a Lost Reason, especially in SMB.

|

Conclusion: Competitive pressure seems to be decreasing in all sales categories other than a one time increase in Q1 in Enterprise.

|

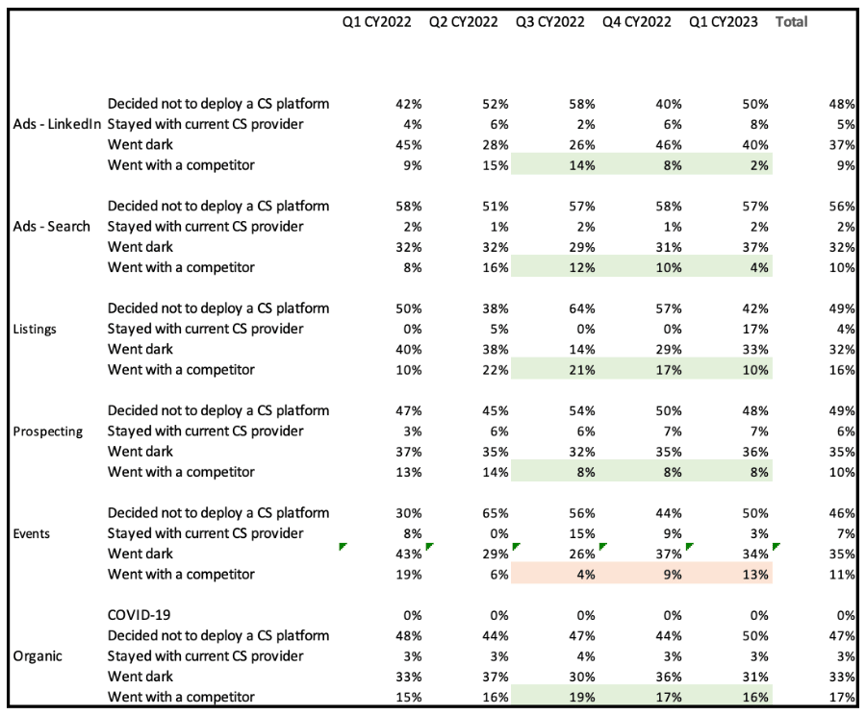

Looked at Closed Lost Reason trending by Strategy to see if “went with a Competitor” is increasing as a Lost Reason.

|

Conclusion: Competitive pressure seems to be flat or decreasing in all Strategies other than Events and since Events represents less than 1% of Pipeline, we conclude that competitive pressure is not contributing to decreasing win rate.

|

Are Unfavorable Macro Conditions Contributing to Declining Win Rate?

Looked at Closed Lost Reason trending by Sales Category to see if “Decided not to deploy a CS platform” is increasing as a Lost Reason, especially in SMB.

|

Conclusion: The data slightly suggests that difficult macro conditions are at play since most Sales Categories experienced an increase in this Lost Reason relative to H1’22. SMB increase is particularly pronounced.

|

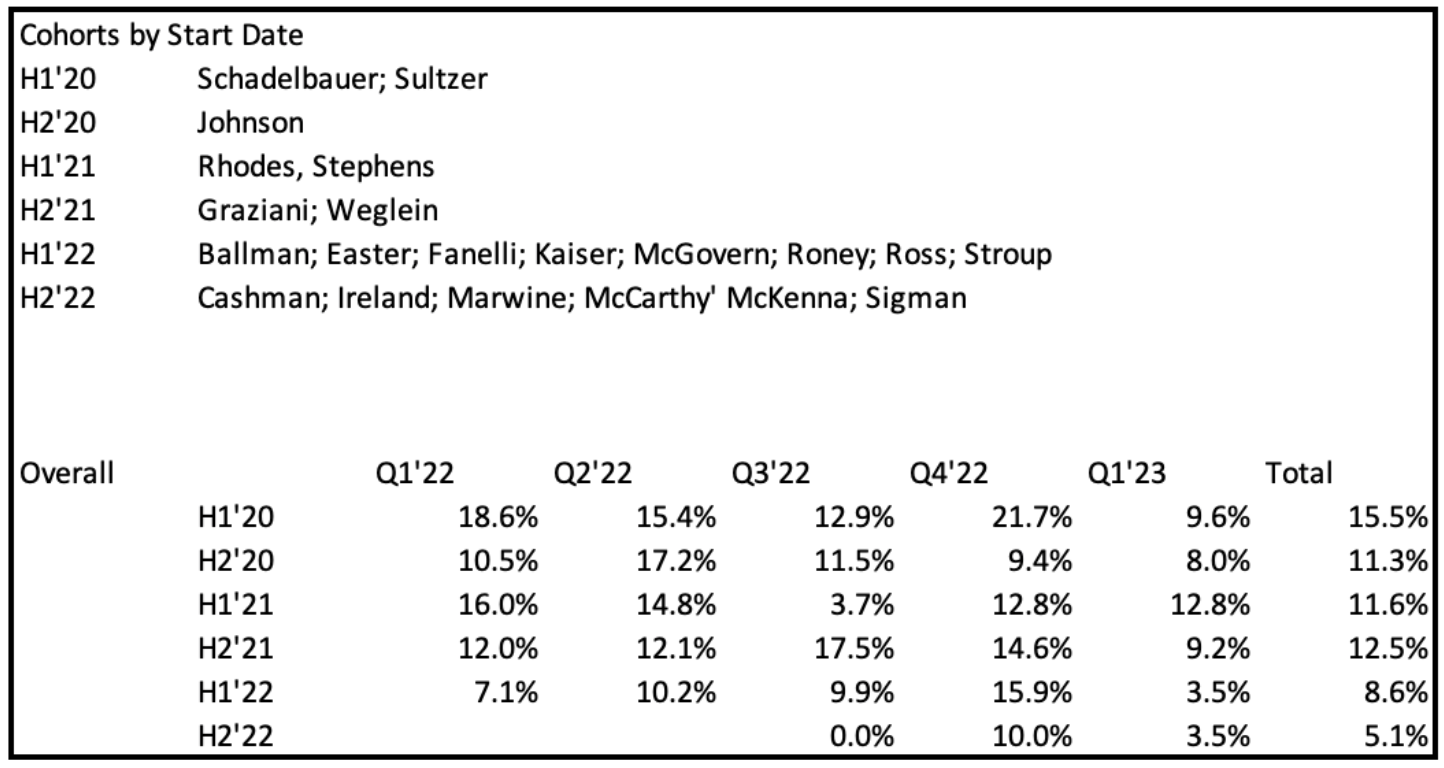

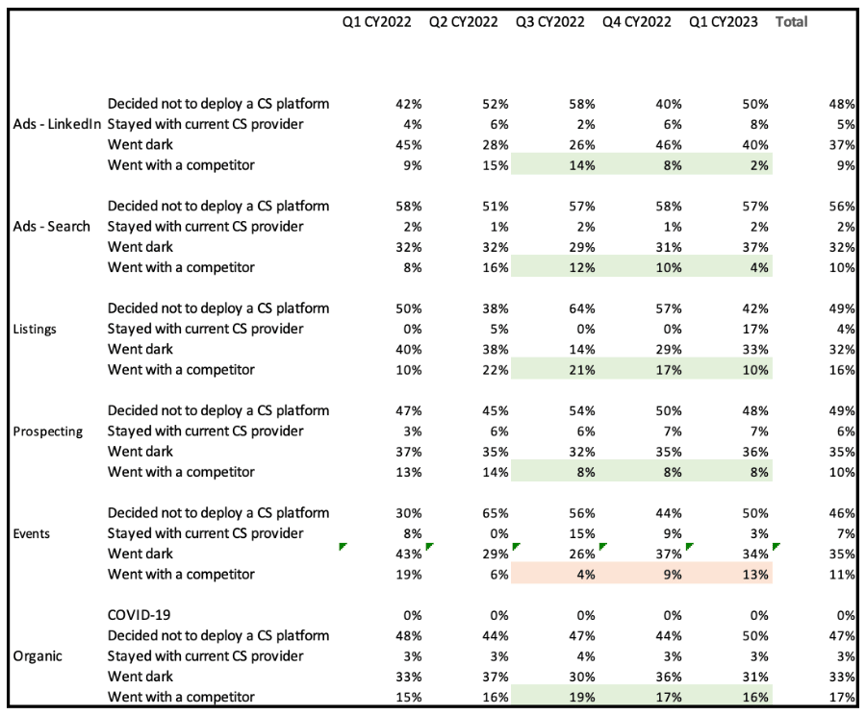

Is Depressed Win Rate a Function of a Less Capable Sales Team?

Looked at win rates by cohort based on start dates

|

Conclusion: While all cohorts other than H1’21 have come down a bit, the decrease is most pronounced among the newest cohorts. Is that a function of skills or opportunity quality?

|

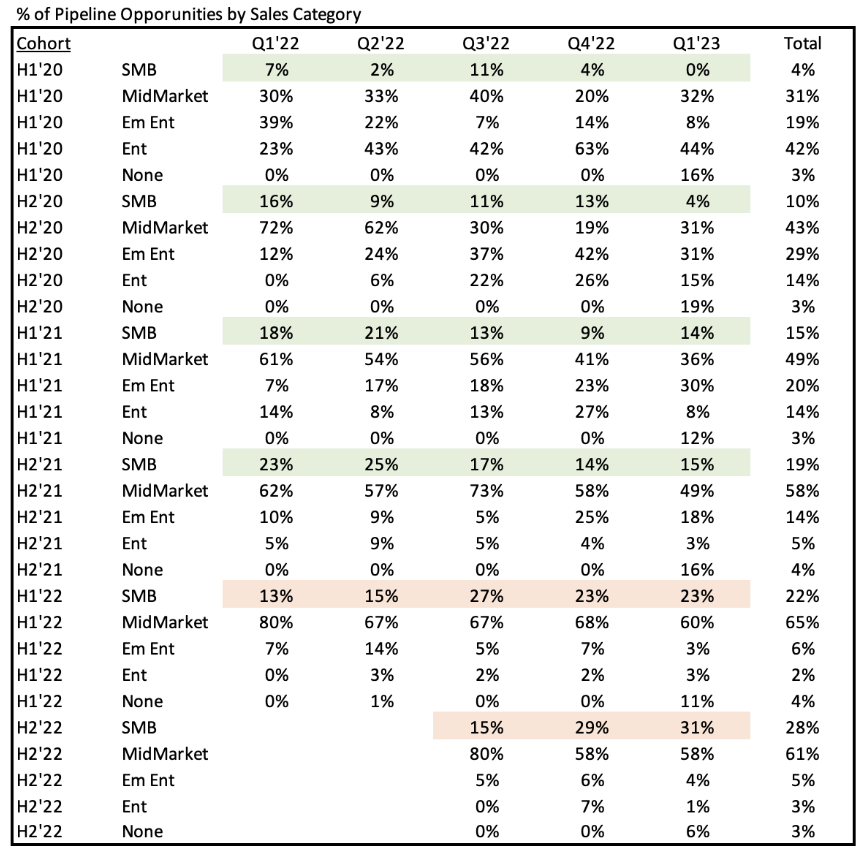

Are the newer sales cohorts getting similar opportunities to the more seasoned reps?

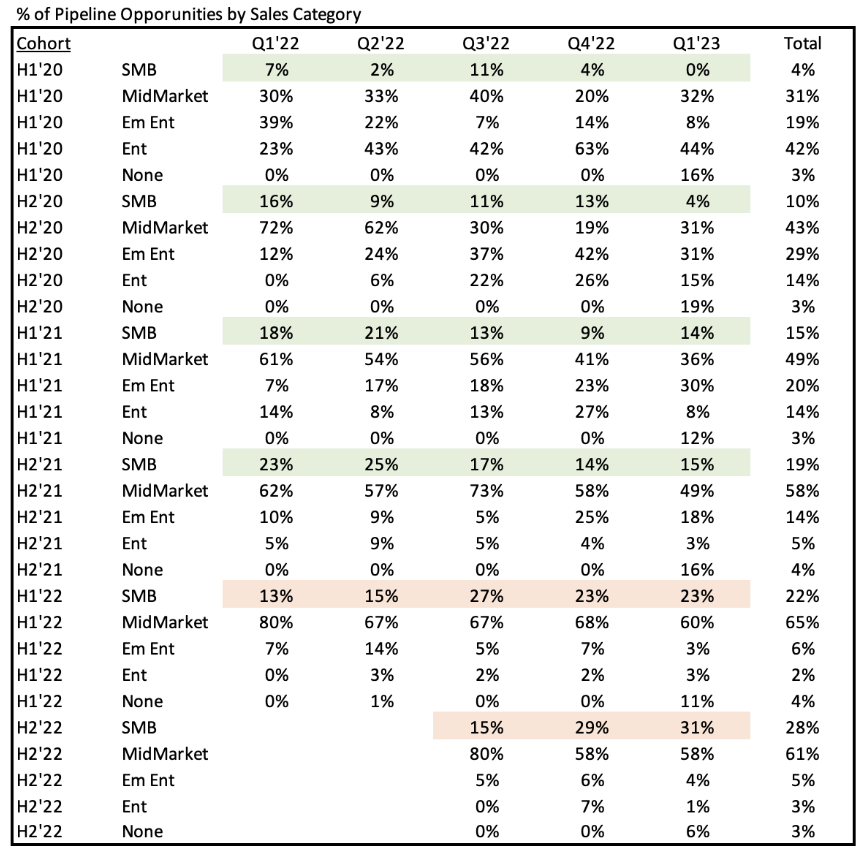

Looked at pipeline opportunity portion by Sales Category for each cohort

|

Conclusion: The newer sales cohorts are seeing an increasing proportion of their pipeline opportunities from SMB while the more seasoned cohorts are seeing a decreasing proportion from SMB. So the question is… does SMB win rate suffer because of the newer sales team or does the newer sales team win rate suffer because of SMB?

|

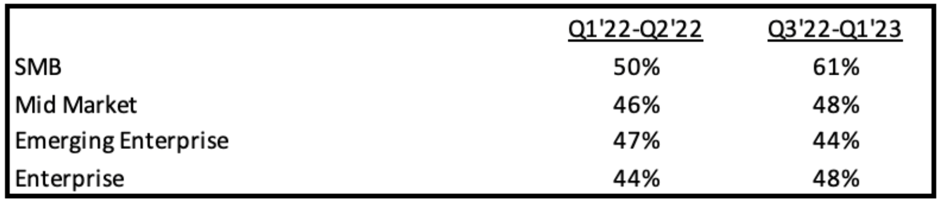

What is cause and effect…SMB or new sales cohorts?

How to Answer: Look at win rate by cohort for each Sales Category to see if newer cohorts are worse across the board.

|

Conclusion: SMB is the bigger differentiator as all cohorts other than H2’21 have terrible win rates with SMB. In fact, the two newest cohorts actually fare better than the three most seasoned cohorts. With that said the newer cohorts are clearly less capable than the more seasoned reps for Mid Market, Em Ent, and Enterprise.

|

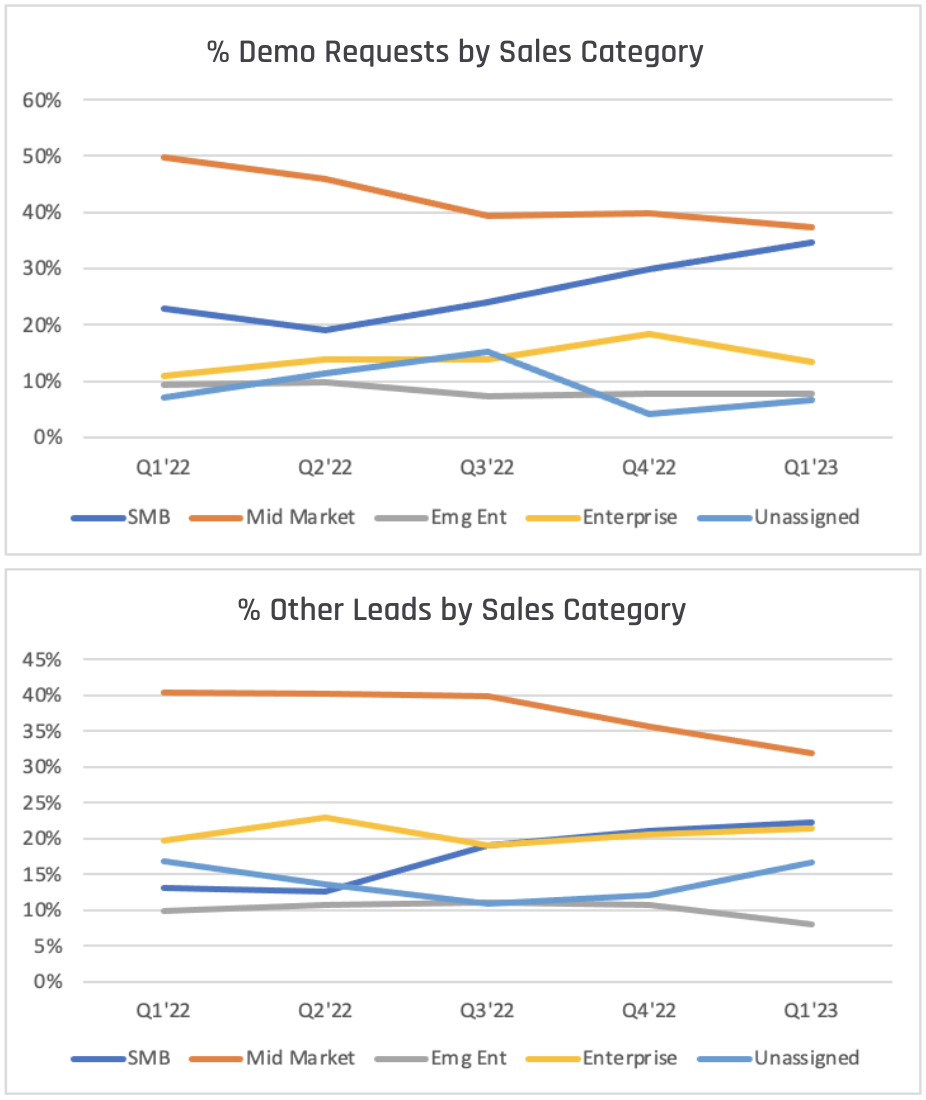

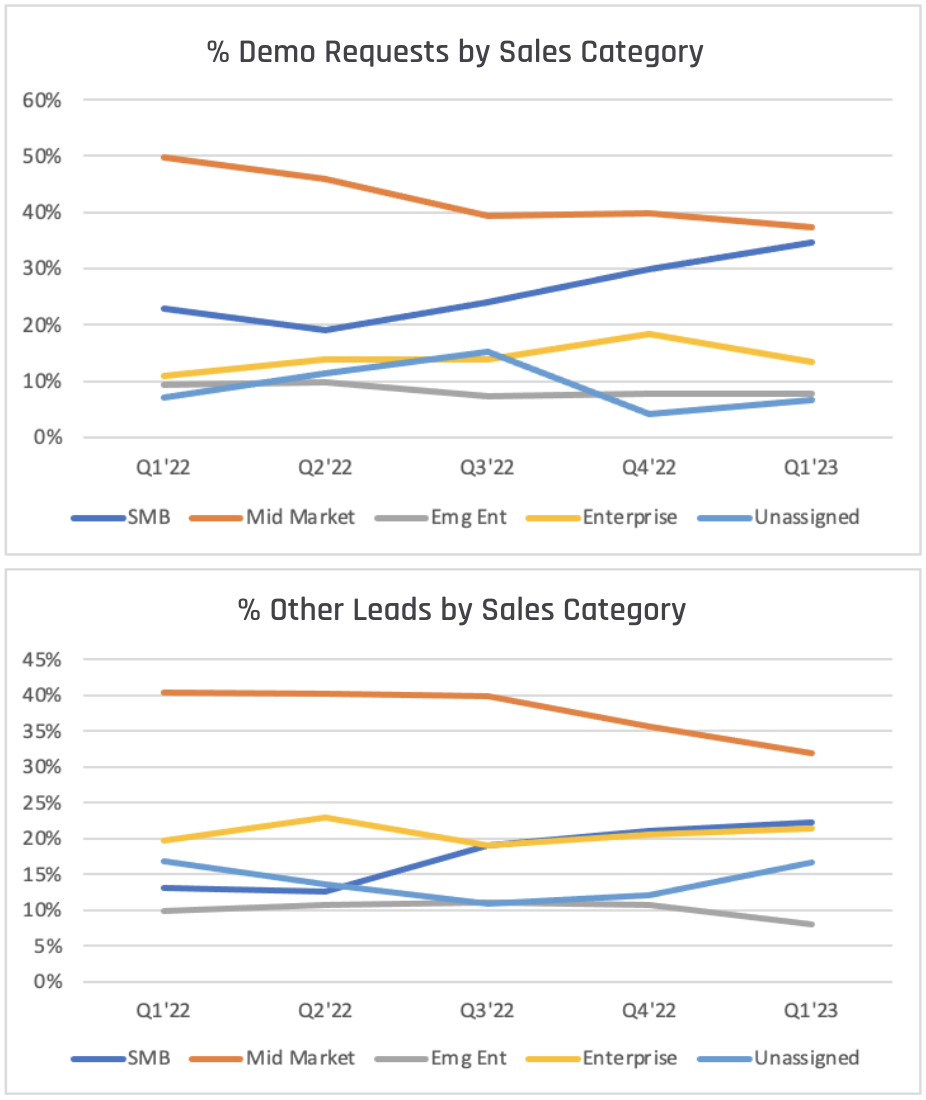

Are we bringing in an increasing proportion of non-ICP prospects?

Given that we know that SMB is non-ICP, looked at top-of-funnel growth rates by Sales Category to see if SMB is becoming more significant.

|

Conclusion: The data is clear. SMB is the fastest growing part of top-of-funnel and represents an outsize portion of top-of-funnel relative to early in 2022.

|

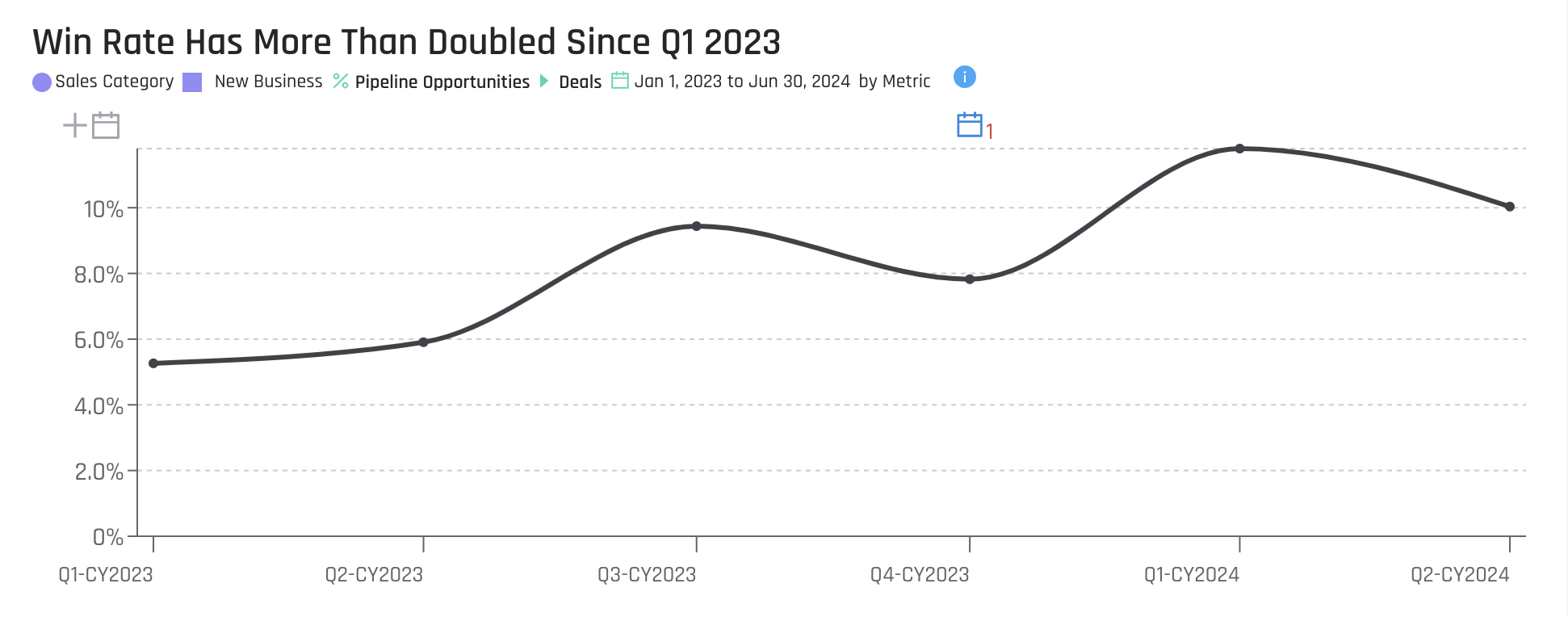

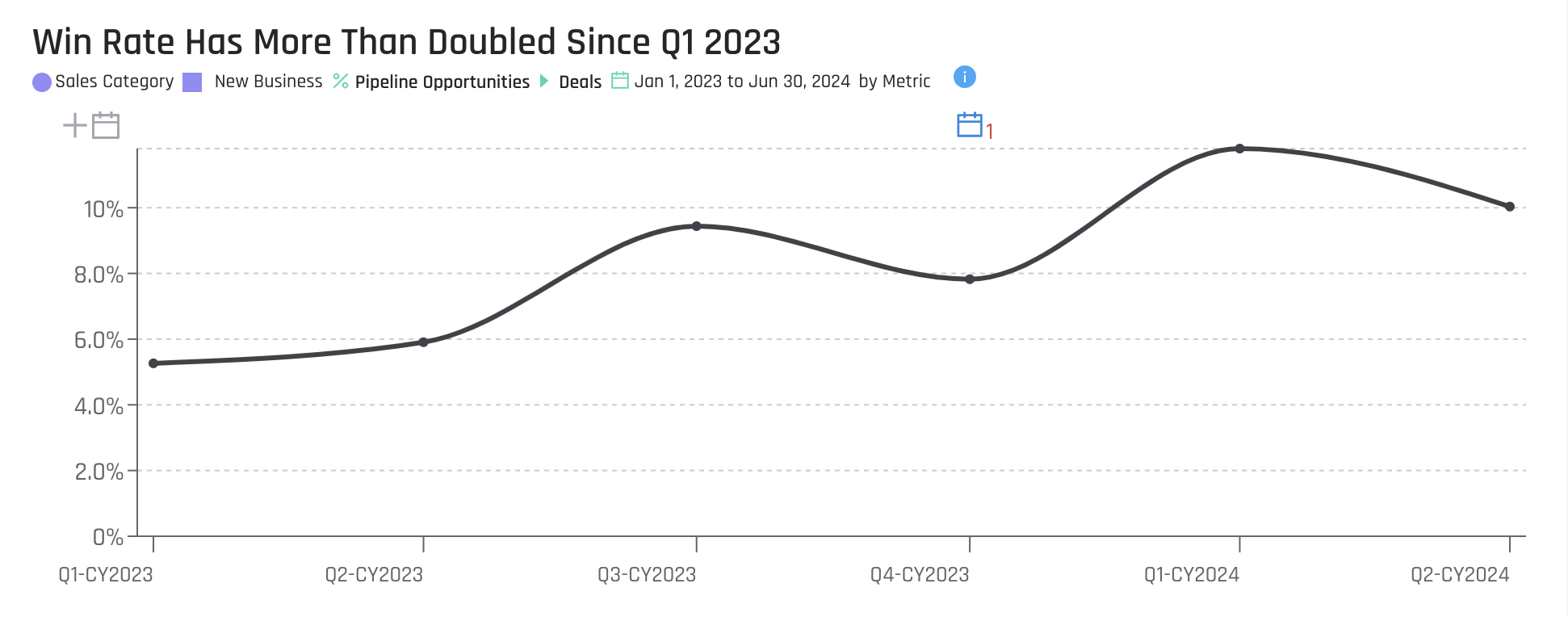

UPDATE: Customer took action on our analyst recommendation

- Customer refocused all their marketing dollars and sales initiatives on true ICP accounts.

- Since Q1 2023, their Win Rate has more than doubled. Q1 2023 = 5.26% vs. Q1 2024 = 11.8%

scaleMatters

scaleMatters

![[GTM Analyst Insight Report] Decreasing Win Rate Across All Channels Especially in SMB Category](https://www.scalematters.com/hubfs/%5BGTM%20Analyst%20Insight%20Report%5D%20Decreasing%20Win%20Rate%20Across%20All%20Channels%20Especially%20in%20SMB%20Category.png)

![[GTM Analyst Insight Report] 4X Increase in Google Ads Spend Negatively Correlated to Pipeline Performance](https://www.scalematters.com/hubfs/%5BGTM%20Analyst%20Insight%20Report%5D%204X%20Increase%20Google%20Ads%20Negatively%20Correlated%20to%20Pipeline%20Performance.png)

![[GTM Analyst Insight Report] Over-Investing in Facebook Ads Channel is Hurting Near Term Bookings](https://www.scalematters.com/hubfs/sM%20-%20Blog/Analyst%20Report%20-%20Surefire%20Local%20-%202020/Analyst%20Report%20Image%20Overinvesting%20Facebook%20Ads%20Hurting%20Bookings%203.png)

![[GTM Analyst Insight Report] Funnel Imbalance - Excess Sales Capacity vs. Top of Funnel Demand](https://www.scalematters.com/hubfs/sM%20-%20Blog/Analyst%20Report%20-%20Salsa%20Labs%20-%202021/%5BGTM%20Analyst%20Insight%20Report%5D%20Funnel%20Imbalance%20-%20Excess%20Sales%20AE%20Capacity.png)